Find the Right Mortgage Broker San Francisco for Your Specific Financing Requirements

Find the Right Mortgage Broker San Francisco for Your Specific Financing Requirements

Blog Article

Discover the Value of Employing an Expert Home Mortgage Broker for Your Home Purchase

Know-how in Mortgage Choices

A specialist mortgage broker brings essential competence that can dramatically enhance the home-buying experience - mortgage broker san Francisco. These experts are skilled in the myriad types of home mortgage items readily available, consisting of fixed-rate, adjustable-rate, and specialty finances like FHA or VA mortgages.

Furthermore, home mortgage brokers stay upgraded on dominating market trends and rates of interest, enabling them to offer educated recommendations. They can examine customers' financial profiles and assist in figuring out qualification, determining potential month-to-month payments, and comparing general expenses related to numerous mortgage items. This level of insight can be invaluable, especially for novice homebuyers that might really feel overwhelmed by the choices offered.

In addition, a mortgage broker can aid clients browse the intricacies of car loan terms, costs, and prospective risks, ensuring that customers make educated decisions. By leveraging their competence, property buyers enhance their opportunities of safeguarding positive home loan problems, inevitably causing a much more monetarily sound and effective home purchase.

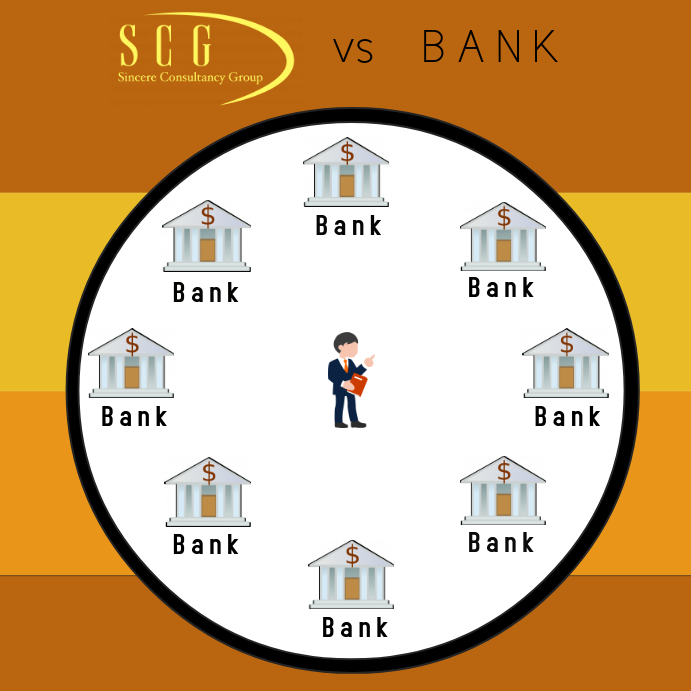

Access to Multiple Lenders

Access to several lending institutions is one of the essential benefits of collaborating with a specialist home loan broker. Unlike individual borrowers that may just take into consideration a restricted number of financing options, mortgage brokers have established partnerships with a broad variety of loan providers, consisting of banks, lending institution, and alternative funding resources. This comprehensive network allows brokers to access a diverse series of lending products and passion rates tailored to the specific requirements of their clients.

By offering numerous financing choices, mortgage brokers equip consumers to make informed decisions. They can compare different terms, rate of interest, and settlement plans, making certain that clients discover the very best fit for their economic scenario. This is especially useful in a rising and fall market where problems can differ substantially from one lending institution to an additional.

Moreover, brokers often have understandings right into special programs and rewards that might not be extensively advertised. This can cause possible cost savings and much better finance problems for customers, inevitably making the home acquiring procedure more efficient and economical. In recap, access to several lending institutions through a specialist home loan broker boosts the loaning experience by providing a bigger option of funding choices and fostering notified decision-making.

Personalized Financial Advice

A specialist home mortgage broker provides personalized monetary support that is tailored to the specific requirements and scenarios of each borrower. By evaluating a customer's financial circumstance, including income, credit report, and long-lasting objectives, a broker can offer insights and referrals that straighten with the borrower's special profile. This bespoke approach ensures that clients are not just presented with generic alternatives, but instead with customized mortgage solutions that fit their certain requirements.

Moreover, brokers have comprehensive knowledge of various funding items and present market fads, enabling them to educate clients regarding the advantages and drawbacks of different financing options. This advice is important for consumers that might feel overloaded by the intricacy of home mortgage choices.

In addition to browsing via various lending criteria, a home loan broker can aid clients understand the ramifications of various lending terms, prices, and linked expenses - mortgage broker san Francisco. This clearness is essential in empowering customers to make enlightened choices that can considerably my blog impact their financial future. Eventually, personalized monetary advice from a mortgage broker cultivates confidence and satisfaction, guaranteeing that customers really feel sustained throughout the home-buying procedure

Time and Price Cost Savings

In addition to supplying tailored monetary assistance, a professional mortgage broker can substantially conserve customers both time and money throughout the home mortgage process. Navigating the complexities of home mortgage alternatives can be overwhelming, particularly for novice property buyers. An experienced broker enhances this process by leveraging their sector knowledge and links to identify the very best home loan items readily available.

Additionally, brokers can aid clients avoid pricey errors, such as selecting the incorrect mortgage kind or forgeting surprise costs. Generally, utilizing a specialist home loan broker is a sensible financial investment that equates to considerable time and economic advantages for buyers.

Tension Reduction Throughout Process

Exactly how can property buyers browse the typically stressful trip of obtaining a mortgage with higher ease? Involving a specialist mortgage broker can dramatically minimize this anxiety. These experts recognize the intricacies of the home loan landscape and can assist customers through each phase of the procedure, ensuring that they remain certain and enlightened in their decisions.

A mortgage broker works as an intermediary, streamlining communication in between lenders and purchasers. They take care of the documents and target dates, which can typically really feel overwhelming. By handling these duties, brokers permit property buyers to concentrate on various other essential elements of their home purchase, lowering total anxiety.

In addition, mortgage brokers have substantial understanding of various finance products and market conditions. This insight allows them to match purchasers with one of the most ideal choices, decreasing the moment spent filtering via unsuitable deals. They also give individualized guidance, aiding customers established reasonable expectations and avoid typical challenges.

Inevitably, hiring a specialist home loan broker not only enhances the mortgage procedure however also boosts the homebuying experience. With professional support, homebuyers can important site approach this essential Discover More Here economic choice with higher comfort, guaranteeing a smoother shift into homeownership.

Final Thought

To conclude, the advantages of employing a specialist mortgage broker dramatically boost the homebuying experience. Their competence in home mortgage options, access to numerous lenders, and capability to provide tailored financial guidance are vital. The possibility for time and price savings, along with stress and anxiety reduction throughout the process, underscores the vital duty brokers play in promoting informed decisions and avoiding pricey risks. Involving a home loan broker ultimately leads to a more successful and effective home acquisition trip.

These specialists are fluent in the myriad kinds of home mortgage items offered, including fixed-rate, adjustable-rate, and specialized financings like FHA or VA home loans.A professional home mortgage broker supplies individualized economic advice that is tailored to the individual requirements and situations of each consumer. Inevitably, customized financial advice from a home mortgage broker cultivates confidence and peace of mind, guaranteeing that customers feel sustained throughout the home-buying procedure.

In enhancement to supplying individualized financial support, a professional home mortgage broker can significantly save clients both time and cash throughout the home mortgage process. Generally, employing a professional home loan broker is a prudent investment that translates to substantial time and monetary advantages for homebuyers.

Report this page